Hampleton Partners, the international mergers and acquisitions and corporate finance advisory firm for technology companies, has advised 2getthere Holding, a manufacturer of driverless electric shuttles for future urban mobility, on its majority acquisition by ZF Friedrichshafen, the global automotive supplier.This is the second autonomous vehicle technology transaction closed by Hampleton within the space of nine months.Carel van Helsdingen, Founder & CEO of 2getthere said: “Hampleton led a great process from start to finish, introducing us to an outstanding partner in ZF that will unlock the next dynamic growth phase of our company. Hampleton’s level of experience and, above all, profound understanding of the automotive market, led us to the best possible transaction.“We’re excited to embark on the next stage of this journey, collaborating with ZF to become the world leader in autonomous vehicles, as we continue to develop and deliver the answer to the world’s future urban mobility needs.”David Riemenschneider, Head of Hampleton’s Automotive Practice commented: “We are extremely proud to have partnered with 2getthere, pioneers in the driverless electric vehicle market who have a legitimate claim to the future of urban mobility. The 2getthere executive team has shown incredible talent, vision and drive to get to this point. I am personally looking forward to seeing the company, led by an outstanding management team, continue to reach new heights in cooperation with ZF.“One thing is clear: autonomous vehicles will not just change future mobility choices but will also transform everything from urban planning, global supply chains and even the way people live, work and play. The tie-up between 2getthere and ZF puts the combined company firmly in control of this revolution.”The engagement was led by David Riemenschneider, with Nicholas Milligan and Anton Røthe supporting the transaction at Hampleton.

Hampleton Partners, the international mergers and acquisitions and corporate finance advisory firm for technology companies, has advised 2getthere Holding, a manufacturer of driverless electric shuttles for future urban mobility, on its majority acquisition by ZF Friedrichshafen, the global automotive supplier.This is the second autonomous vehicle technology transaction closed by Hampleton within the space of nine months.Carel van Helsdingen, Founder & CEO of 2getthere said: “Hampleton led a great process from start to finish, introducing us to an outstanding partner in ZF that will unlock the next dynamic growth phase of our company. Hampleton’s level of experience and, above all, profound understanding of the automotive market, led us to the best possible transaction.“We’re excited to embark on the next stage of this journey, collaborating with ZF to become the world leader in autonomous vehicles, as we continue to develop and deliver the answer to the world’s future urban mobility needs.”David Riemenschneider, Head of Hampleton’s Automotive Practice commented: “We are extremely proud to have partnered with 2getthere, pioneers in the driverless electric vehicle market who have a legitimate claim to the future of urban mobility. The 2getthere executive team has shown incredible talent, vision and drive to get to this point. I am personally looking forward to seeing the company, led by an outstanding management team, continue to reach new heights in cooperation with ZF.“One thing is clear: autonomous vehicles will not just change future mobility choices but will also transform everything from urban planning, global supply chains and even the way people live, work and play. The tie-up between 2getthere and ZF puts the combined company firmly in control of this revolution.”The engagement was led by David Riemenschneider, with Nicholas Milligan and Anton Røthe supporting the transaction at Hampleton.

Related and recommended

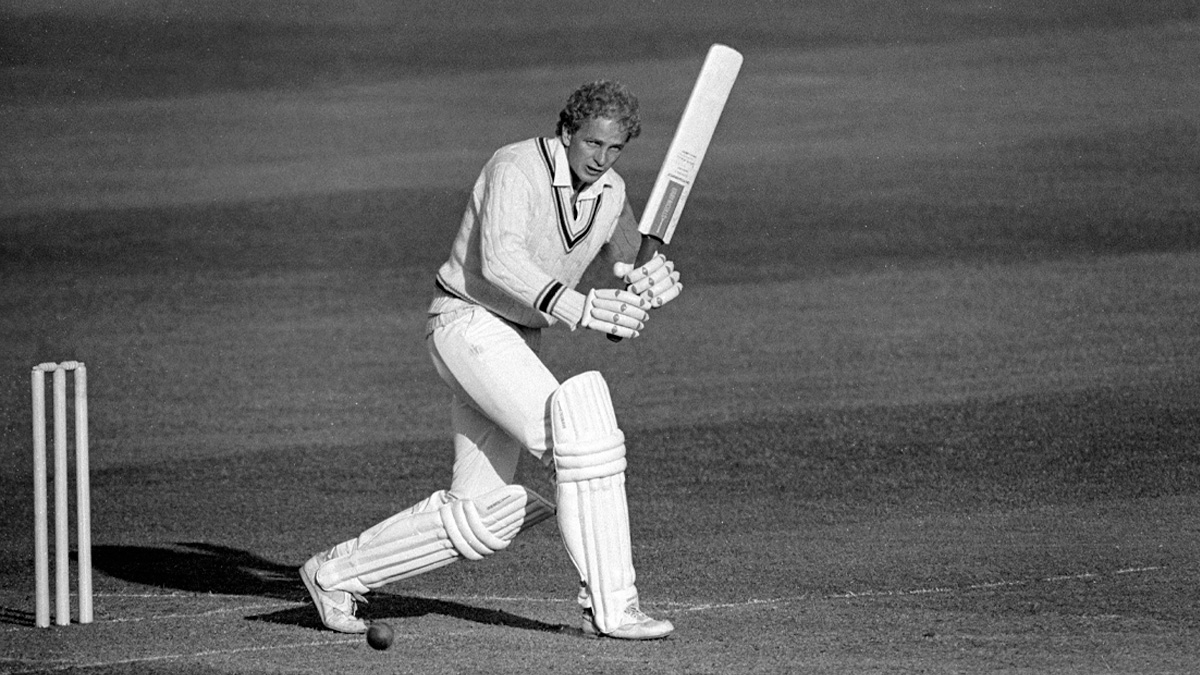

Spells of rare sporting brilliance show that finding intense concentration relies on achieving balance in your life

Rohan Blacker looks back at his time with e-commerce pioneer Sofa.com and explains the thinking behind his latest online furniture project

Rory Sutherland is one of the UK’s best-known marketing thinkers. He sets out why businesses should rethink how they value marketing, from direct mail to call centres and customer kindness

Leaders must realise the tech revolution can achieve its full potential only when human values remain central to change